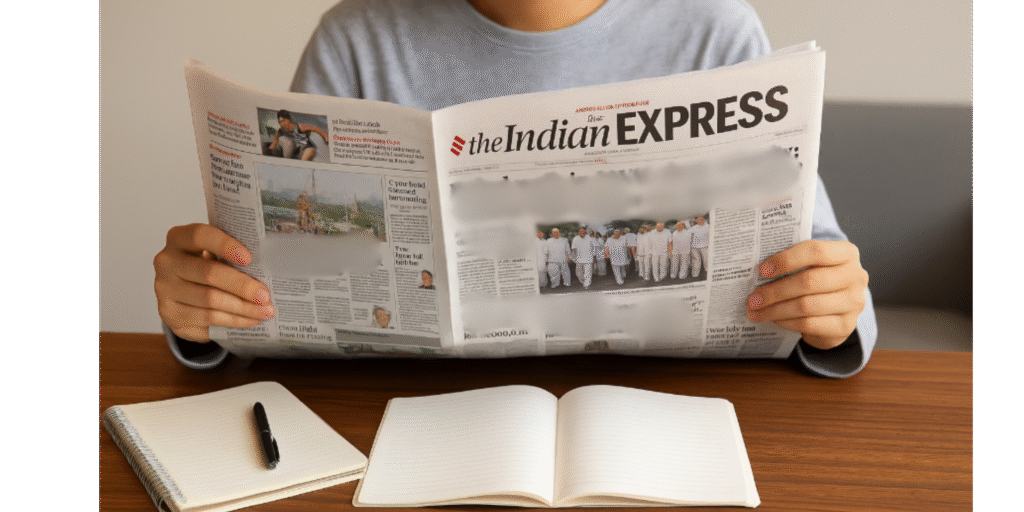

US Tariffs on Patented and Branded Drugs – Impact on Indian Pharmaceutical Exports

In 2025, the United States Trade Representative (USTR) announced the imposition of additional tariffs on patented and branded pharmaceutical imports, citing unfair pricing practices and the need to promote domestic manufacturing.

This move has raised significant concerns for India’s pharmaceutical sector, one of the largest exporters of generic medicines and bulk drugs to the U.S.

For UPSC aspirants, this issue connects directly to GS Paper 3 (Economy, Trade Policy, and WTO) and GS Paper 2 (India–US Relations, IPR Issues).

Background: The US Tariff Policy Shift

The U.S. has long been critical of India and China’s pricing and patent regimes, claiming they affect innovation incentives for American pharma companies.

Under the new policy, tariffs ranging from 5–10% will be applied to imported patented and branded drugs, particularly those sourced from developing economies.

The move is seen as part of the U.S. strategy to:

Reshore pharmaceutical manufacturing, reducing dependency on Asia.

Encourage R&D investment within the U.S.

Address trade imbalances amid global economic realignments.

India’s Position in the Global Pharmaceutical Trade

🇮🇳 India is the world’s largest supplier of generic medicines, accounting for:

20% of the global volume of pharmaceutical exports.

Nearly 40% of generic drug supply in the U.S. market.

Major exports include formulations, APIs (Active Pharmaceutical Ingredients), and biopharmaceuticals.

Key trading partners: U.S., UK, South Africa, Nigeria, Russia, and Latin America.

Impact on India’s Pharmaceutical Sector

⚠️ 1. Short-Term Trade Slowdown

Increased tariffs may reduce profit margins for Indian exporters.

Patented and branded drug manufacturers (like Sun Pharma, Dr. Reddy’s, Lupin) may face reduced competitiveness in the U.S. market.

💊 2. Shift in Export Strategy

Indian companies may pivot to generic drug expansion, biosimilars, and emerging markets in Africa and Latin America.

📉 3. Pressure on IPR and Pricing Policy

The U.S. move revives debates over India’s patent laws and compulsory licensing provisions under the Indian Patents Act, 1970.

India may face renewed scrutiny in the USTR’s Special 301 Report, which identifies countries violating IPR norms.

📈 4. Opportunity for Domestic Manufacturing

Tariffs could indirectly boost ‘Make in India’ and Pharma Vision 2030 initiatives, encouraging domestic API production and innovation-based R&D.

India’s Response and Policy Measures

India’s Ministry of Commerce and the Pharmaceutical Export Promotion Council (Pharmexcil) have begun consultations to mitigate potential losses.

Possible steps include:

Negotiating tariff exemptions for critical life-saving drugs.

Expanding bilateral trade dialogues under the India–US Trade Policy Forum.

Strengthening domestic patent and pricing transparency frameworks.

Boosting API manufacturing through the Production Linked Incentive (PLI) Scheme.

WTO & Global Trade Implications

The new tariffs raise questions under WTO’s Most Favored Nation (MFN) principle, as targeted tariffs on specific sectors may be viewed as discriminatory trade practices.

India could explore:

Raising the issue at WTO Dispute Settlement Mechanism.

Forming alliances with other affected countries (like Brazil, Thailand) for collective representation.

UPSC Relevance

GS Paper 2: India–U.S. Relations, Global Trade Governance, IPR Issues

GS Paper 3: Indian Economy, Trade Policy, Industrial Strategy

Essay Paper: “Balancing Innovation with Access: The Future of Global Healthcare Trade”

💡 Example UPSC Question:

“Discuss how tariff and non-tariff barriers imposed by developed nations affect India’s export competitiveness in the pharmaceutical sector.”

Way Forward

India’s pharmaceutical sector must adopt a dual strategy — continue advocating for equitable trade norms, while simultaneously investing in innovation-driven R&D and diversified export markets.

Long-term solutions include:

Enhanced bilateral trade diplomacy.

Building domestic research ecosystems.

Strengthening regulatory harmonization with global standards.

Conclusion

The U.S. tariff move may cause short-term disruptions, but it also highlights the need for India to move up the global pharma value chain.

By focusing on research, quality, and affordability, India can sustain its role as the “Pharmacy of the World”, even in an era of protectionist trade policies.

In essence, the challenge is an opportunity — to transform Indian pharma from a low-cost supplier to a global innovator.

📘 For UPSC Aspirants – Recommended Reading

Aura IAS GS Paper 3 PYQs (2013–2025)

✔️ Indian Economy, Trade & WTO, Industrial Policy

✔️ Model Answers with Government Reports & Economic Survey references

🛒 Explore Here:

👉 https://auraias.in/shop/